The Hsmb Advisory Llc Ideas

The Hsmb Advisory Llc Ideas

Blog Article

Hsmb Advisory Llc - The Facts

Table of ContentsThe 10-Second Trick For Hsmb Advisory Llc6 Easy Facts About Hsmb Advisory Llc ExplainedThe Greatest Guide To Hsmb Advisory LlcGetting The Hsmb Advisory Llc To Work

- an insurance policy firm that moves risk by buying reinsurance. - an adjustment in the interest price, death presumption or reserving method or other factors affecting the book computation of plans in pressure.

- a professional designation awarded by the American Institute of Building and Casualty Underwriters to individuals in the residential property and obligation insurance coverage field that pass a collection of examinations in insurance, danger management, economics, money, administration, audit, and law. Designates need to also contend least 3 years experience in the insurance coverage business or relevant area.

- expenses expected to be incurred about the adjustment and recording of mishap and health, auto clinical and employees' compensation cases. - A kind of responsibility insurance policy type that just pays if the both occasion that creates (triggers)the insurance claim and the actual claim are sent to the insurance coverage company during the policy term - a method of identifying prices for all candidates within a given collection of features such as individual demographic and geographic place.

If the insured falls short to maintain the amount defined in the clause (Normally a minimum of 80%), the insured shares a higher proportion of the loss. In medical insurance a percent of each case that the insured will bear. - an arrangement to get payments as the buyer of an Alternative, Cap or Floor and to pay as the vendor of a various Choice, Cap or Floor.

The 15-Second Trick For Hsmb Advisory Llc

- an investment-grade bond backed by a swimming pool of low-grade debt safety and securities, such as junk bonds, divided into tranches based upon various degrees of credit report risk. - a kind of mortgage-backed safety and security (MBS) with different pools of pass-through safety and security mortgages which contain varying courses of holders and maturities (tranches) with the benefit of foreseeable capital patterns.

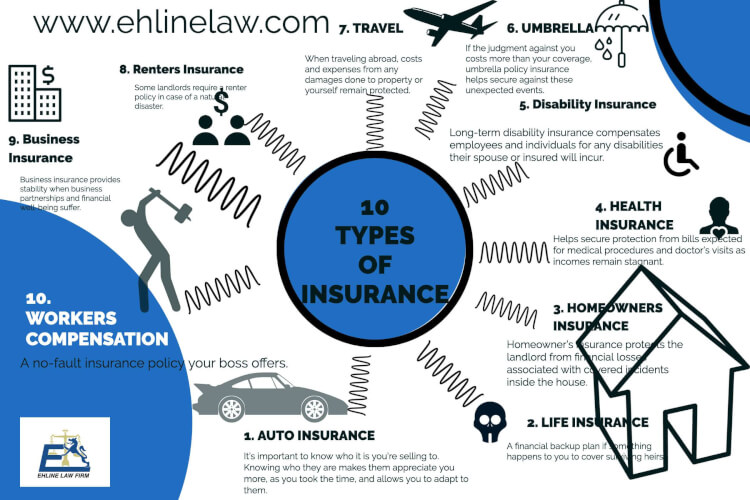

- an indication of the profitability of an insurance provider, determined by adding the loss and expense ratios. - day when the company initially ended up being bound for any kind of insurance policy threat by means of the issuance of policies and/or getting in into a reinsurance arrangement. Like "efficient date" of protection. Health Insurance St Petersburg, FL. - insurance coverage for automobile owned by a business involved in business that protects the guaranteed against economic loss as a result of legal liability for electric motor lorry related injuries, or damage to the property of others brought on by accidents emerging out of the ownership, upkeep, use, or care-custody & control of an automobile.

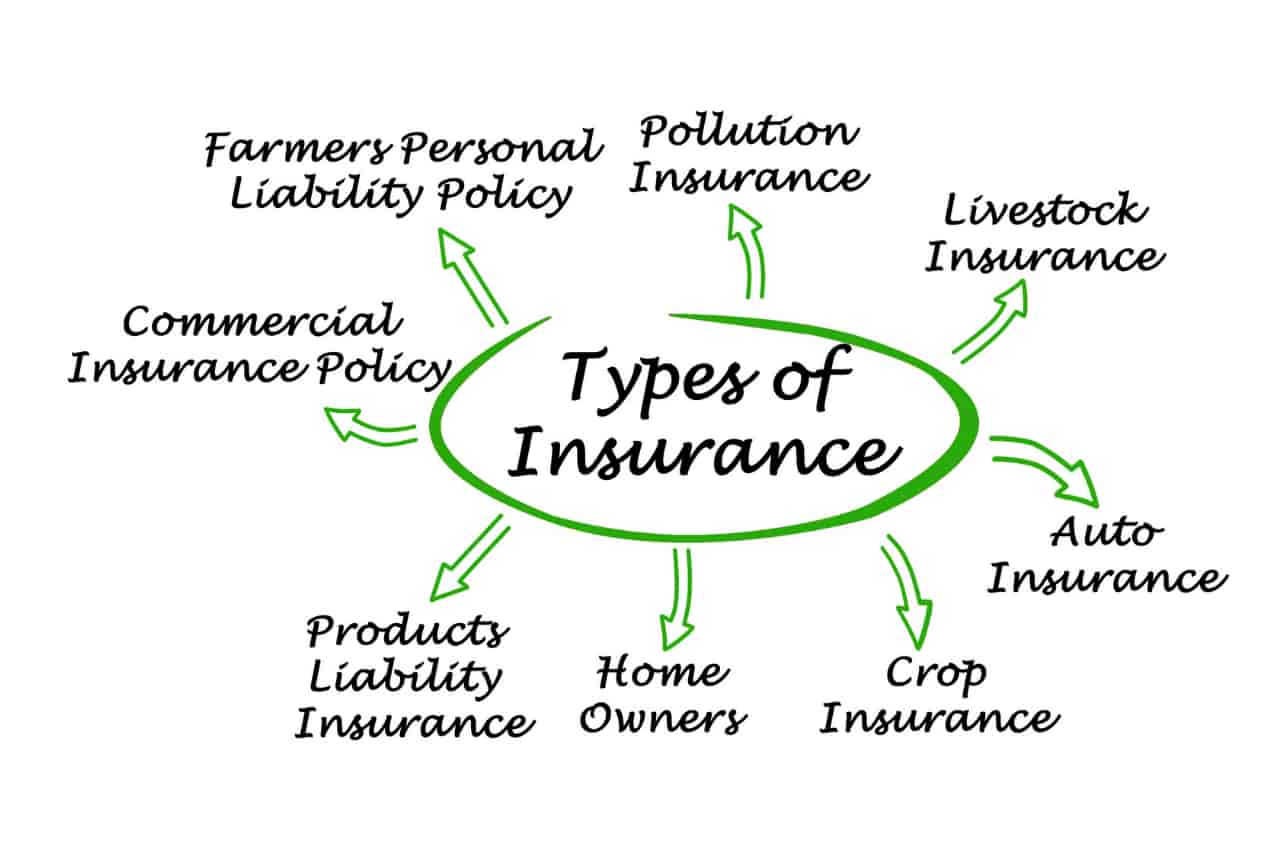

- earthquake home insurance coverage for commercial endeavors. - a commercial bundle policy for farming and ranching risks that consists of both residential property and obligation protection. Coverage consists of barns, stables, various other ranch frameworks and ranch inland aquatic, such as mobile devices find out here and livestock. - different flooding insurance plan sold to business endeavors - https://www.avitop.com/cs/members/hsmbadvisory.aspx.

Hsmb Advisory Llc - The Facts

- a kind of mortgage-backed safety and security that is secured by the financing on an industrial residential or commercial property. - plan that packages two or more insurance protections securing an enterprise from different property and responsibility threat direct exposures. Often includes fire, allied lines, various other coverages (e. g., difference in problems) and responsibility coverage.

- a rating system where standard score is developed and generally readjusted within certain standards for every group on the basis of awaited usage by the team's workers. - a five-digit recognizing number appointed by NAIC, assigned to all insurance coverage business submitting financial data with NAIC. - policies covering the responsibility of professionals, plumbers, electrical contractors, repair service stores, and comparable companies to individuals that have sustained bodily injury or home damages from malfunctioning job or operations completed or abandoned by or for the insured, away from the insured's properties.

- protection of all company responsibilities unless specifically excluded in the policy agreement. - detailed responsibility coverage for exposures occurring out of the home facilities and activities of people and family members. (Non-business responsibility exposure security for people.) - policies that provide totally guaranteed indemnity, HMO, PPO, or Cost for Solution protection for medical facility, clinical, and medical expenses.

How Hsmb Advisory Llc can Save You Time, Stress, and Money.

- residential or commercial property loss sustained from two or more hazards in which just one loss is covered however both are paid by the insurance company as a result of simultaneous case. - demands defined in the insurance policy contract that have to be promoted by the insured to receive indemnification. - home owners insurance policy offered to condominium proprietors occupying the explained residential or commercial property.

- called for by some territories as a hedge versus adverse experience from procedures, particularly unfavorable claim experience. - the responsibility of an insured to individuals that have actually sustained physical injury or residential property damage from work done by an independent contractor employed by the guaranteed to carry out work that was prohibited, naturally harmful, or straight managed by the insured - legal or legal stipulation requiring companies to provide care to an enrollee for some period adhering to the day of a Health insurance plan Firm's insolvency.

- reserves established up when, due to the gross premium structure, the future benefits exceed the future web premium. Agreement books remain in addition to insurance claim and premium books. - liability protection of a guaranteed who has presumed the legal responsibility of another party by composed or dental contract. Consists of a contractual liability plan providing insurance coverage for all obligations and responsibilities sustained by a solution agreement provider under the regards to solution agreements provided by the service provider (https://myanimelist.net/profile/hsmbadvisory).

Report this page